Government Spending

The federal US government spends far more than it makes, running a budget deficit. To cover the deficit, the government sells securities to the public by promising to pay back the face value with interest in the future.

Deficits only include the budget shortfall within a measured year. Debt is the accumulation of all deficits.

Taxes

Federal Taxes

Individual income tax is paid by individuals. It is a progressive tax since it increases with income.

Payroll taxes are withheld from employee pay to fund Social Security and Medicare. It is a proportional tax as a fixed percentage until a limit, after which it becomes regressive.

Corporate income tax is the tax on profits.

Excise taxes are charged for specific goods such as alcohol or tobacco.

Estate/gift taxes are charged for large transfers of assets.

State and Local Taxes

State and local governments may charge many forms of taxes. The federal government also gives revenue to lower levels of government.

National Debt

The debt/GDP ratio is a metric to measure national debt.

Fiscal Policy

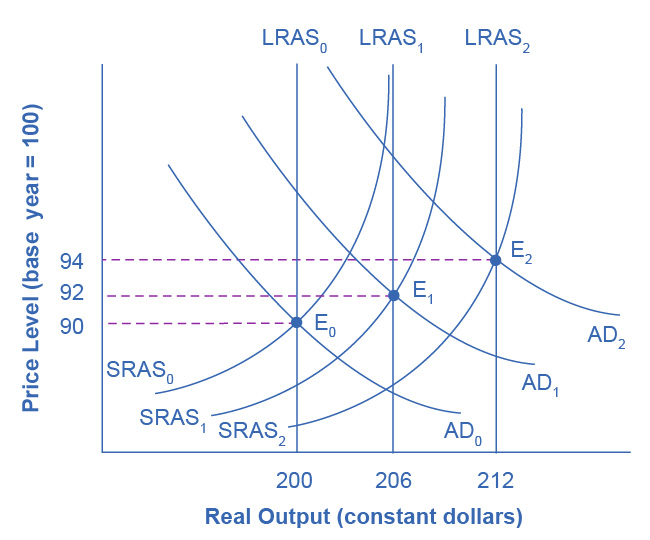

Fiscal policy refers to government spending and tax policy. Expansionary fiscal policy shifts AD to the right and contractionary fiscal policy to the left.

|

|---|

| In a healthy economy, both AD and LRAS shift outward |

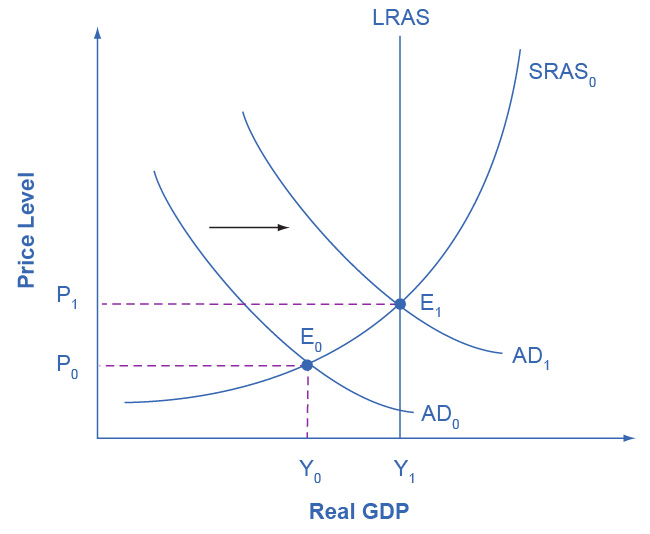

Expansionary Policy

To stimulate aggregate demand, the government can:

- Increase disposable income by reducing individual income tax and payroll tax

- Increase investment by reducing corporate income tax

- Increase government spending on final goods and services

- Provide grants to lower levels of government

| |

|---|---|

| Expansionary fiscal policy shifts the AD curve outward |

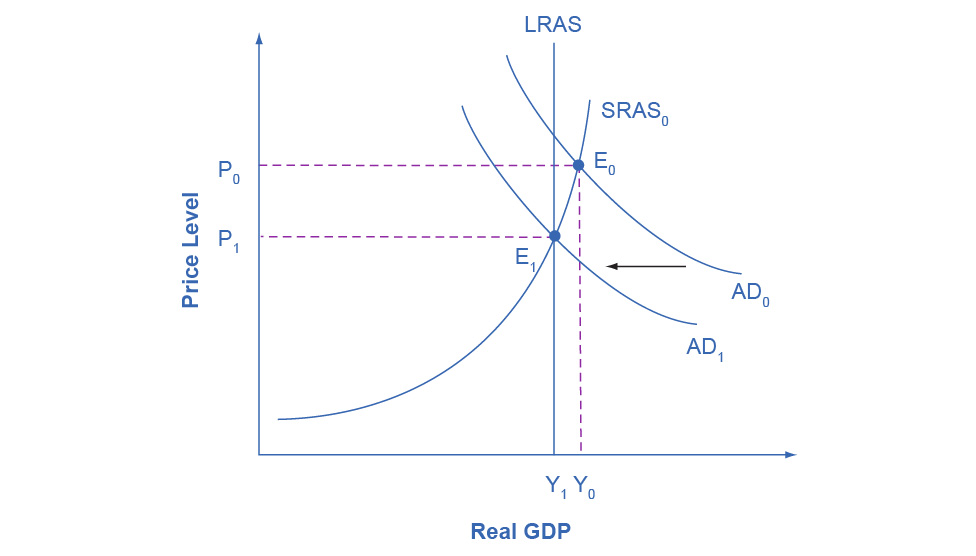

Contractionary Fiscal Policy

Running a large deficit can cause the equilibrium to fall above the LRAS curve, creating inflationary pressure. This can be countered by implementing the opposite of expansionary policy.

|

|---|

| Contractionary fiscal policy shifts the AD curve inward |

Automatic Stabilizers

Discretionary fiscal policy refers to new laws passed to explicitly changing taxation or spending.

Automatic stabilizers are existing programs that will correct aggregate demand such as food stamps or employment insurance.

Counterbalances

In an economic boom, more taxes are paid and less welfare spending is required. These are contractionary measures.

In a recession, less taxes are paid and more is spent on welfare programs. These are expansionary measures.

Standardized Employment Budget

The standardized employment budget is an annual calculation of the budget at potential GDP. This metric can be compared to the actual budget.

During recessions, the actual deficit is typically greater than the standardized employment deficit.

Problems with Discretionary Fiscal Policy

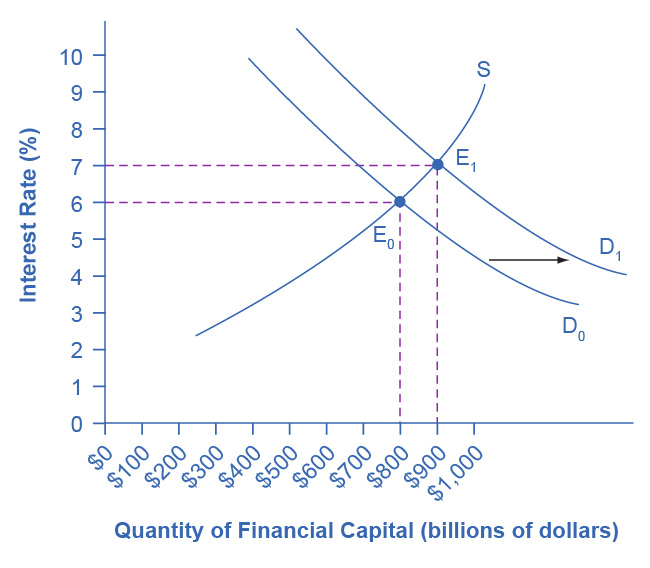

Interest Rates

|

|---|

| Fiscal policy can increase interest rates |

When fiscal policy requires increased government spending and by extension, borrowing, interest rates will increase due to a shift in the demand curve of capital.

When expansionary fiscal policy triggers interest rate increases, households and firms are “crowded out”, discouraged from borrowing. This can cause a decrease in AD, which is why monetary and fiscal policy should be coordinated.

Time Lags

Fiscal policy takes much longer to implement compared to monetary policy.

Recognition lag is the delay in the process to recognize that a recession has occurred, which starts the legislative process to create fiscal policies.

Legislative lag is the time it takes to pass a bill in legislature.

Implementation lag is the time it takes to transfer funds to implement legislated programs.

Temporary Policy

Temporary fiscal policies have less of an effect than permanent policies. However, the cyclical nature of the economy requires different policies for different parts of the cycle.

Structural Change

In recovering from recession, certain sectors of the economy may not recover to their earlier state. People who lose their jobs to structural change will need gain different skills while jobs open in different markets. Although fiscal policy can stimulate AD, these processes take time.

Politics

Politicians prefer expansionary policy far more than contractionary policy. They can be hesitant to switch policy to raise taxes and cut spending when production is above potential GDP. Unfortunately, expansionary fiscal policy at such levels will only drive inflation through increased competition between employers.