Forex Markets

If you have a Euro and want a dollar, you’ll have to go through a foreign exchange market.

Demand and Supply

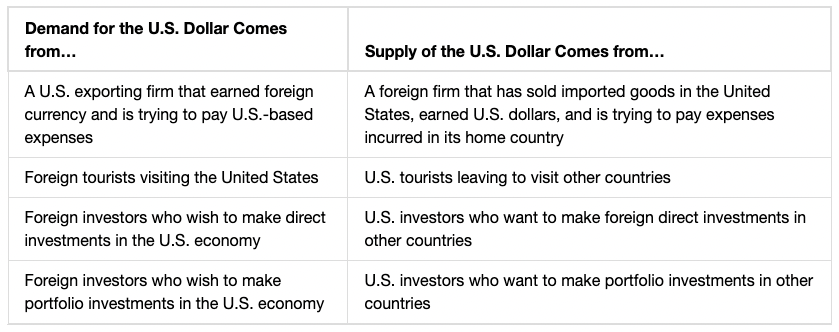

In a forex market, suppliers are also demanders, since one must is selling a currency to purchase another. Participants in the market can be categorized into four groups:

- International firms purchase inputs in the currency of the production country but sell in the export market currency.

- Tourists will need foreign currency to spend while abroad.

- International investors can be split into two categories:

- Foreign direct investments (FDIs) are the purchase or creation of businesses in another country

- Portfolio investments are direct financial investments

Forex investments are often based on how the rate is expected to change. Risk can be hedged by entering a contract for a guaranteed rate over a specified period.

|

|---|

| Table from OpenStax |

Market Participants

Forex transactions are primarily facilitated by banks and firms called dealer in the interbank market. The majority of volume is comprised of transactions between dealers.

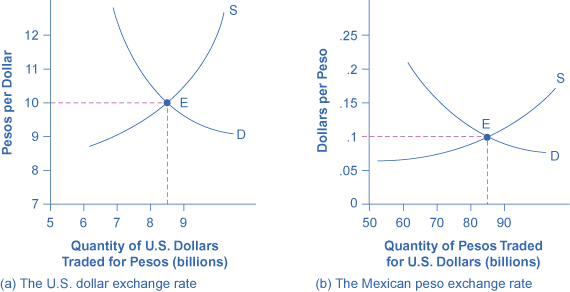

Currency Strength

A currency appreciates when its exchange rate rises and depreciates when its rate falls.

|

|---|

| Group responses to USD strength |

Supply and Demand Shifts

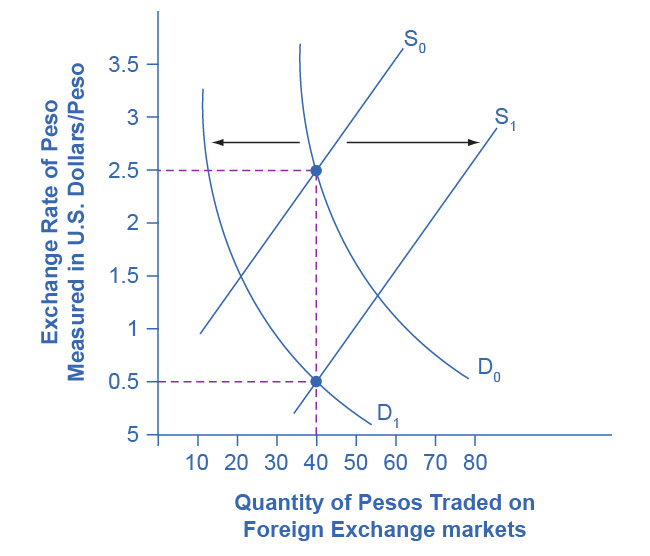

|

|---|

| A supply and demand model for the USD and MXN |

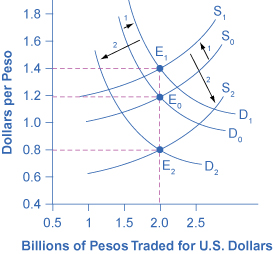

Future Expectations

|

|---|

| Movement of the supply curve immediately follows the demand curve |

Changes in future expectation of a currency’s strength will cause both a movement in supply and demand. Buyers will want more Pesos while sellers will keep their Pesos if the exchange rate is expected to rise, bringing up the rate.

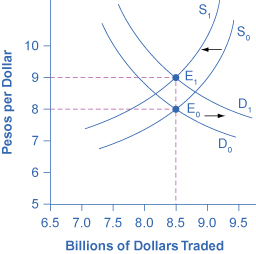

Rates of Return

|

|---|

| Higher return rates attract foreign investment and thus currency demand |

Central banks can increase foreign exchange rates much like interest rates through monetary policy.

Relative Inflation

|

|---|

| Inflation decreases purchasing power |

Higher relative inflation makes currencies undesirable to hold.

Purchasing Power Parity

Although exchange rates fluctuate greatly in the short run, they will tend to the PPP.

Macroeconomic Effects

AD/AS

Changing exchange rates can incentivize the import or export of goods, shifting aggregate demand.

Rate Fluctuations

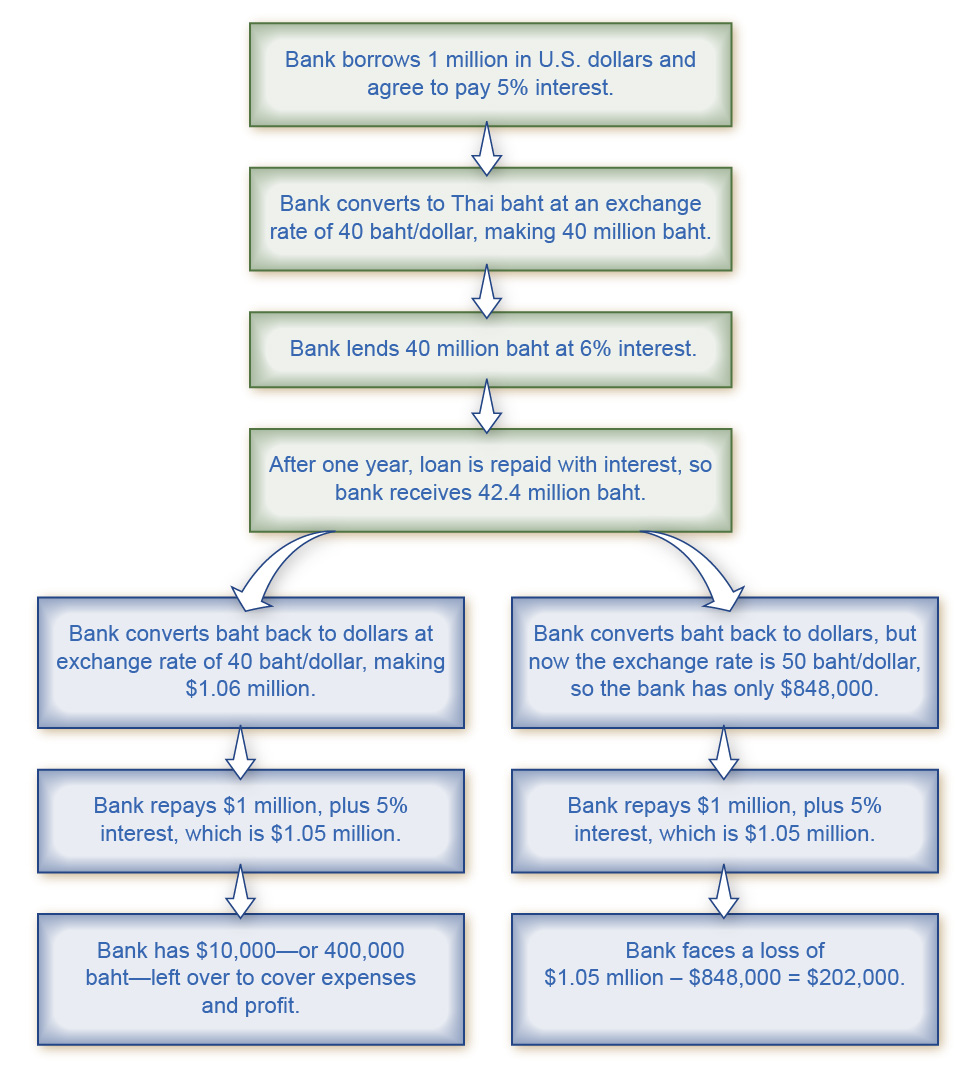

|

|---|

| Banks can borrow foreign currency and lend in domestic currency |

Since the majority of forex transactions occur using a few major currencies, banks will exchange their currency for access to capital. This is profitable in conditions where the rate is stable, but a large fluctuation could incur a massive loss.

Exchange Rate Policies

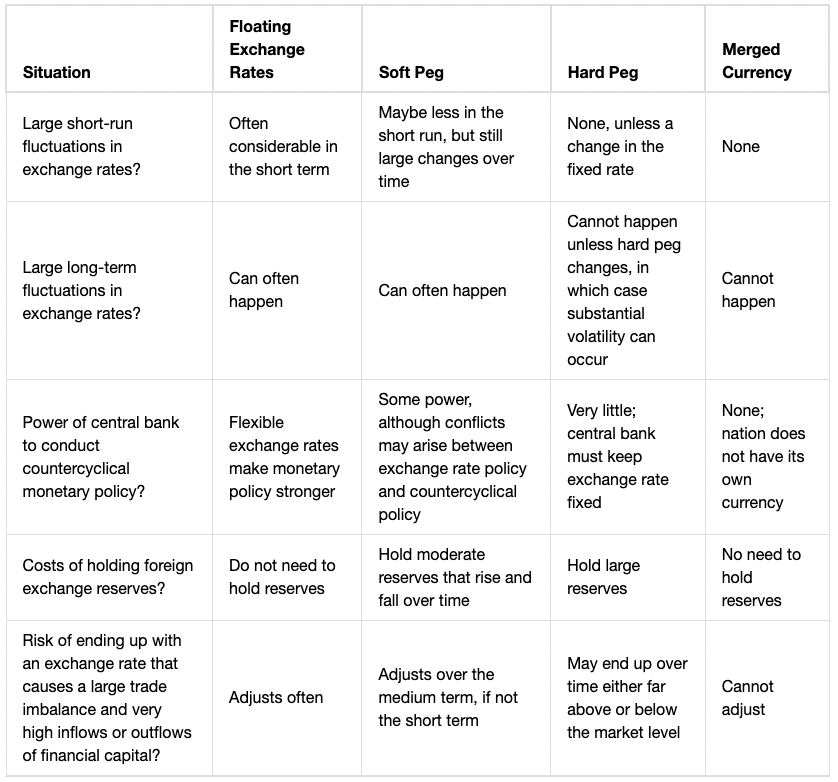

The four major types of exchange rates are:

- Floating rates: the exchange rate is determined by the market

- Soft pegs: central banks will respond to large fluctuations

- Hard pegs: the exchange rate is fixed

- A pegged rate incurs a shortage or a surplus at disequilibrium

- Merged currency: a common currency is used

|

|---|

| Tradeoff table from OpenStax |