Neoclassical economists believe that the economy hovers around natural unemployment and potential GDP.

Economy Size

Since real GDP tends to potential GDP over the long run, real is determined by potential. To benchmark economic performance, economists compare the two.

For GDP to grow, advancements must be made increase productivity. This can be quantified by metrics such as capital per person, both physical and human.

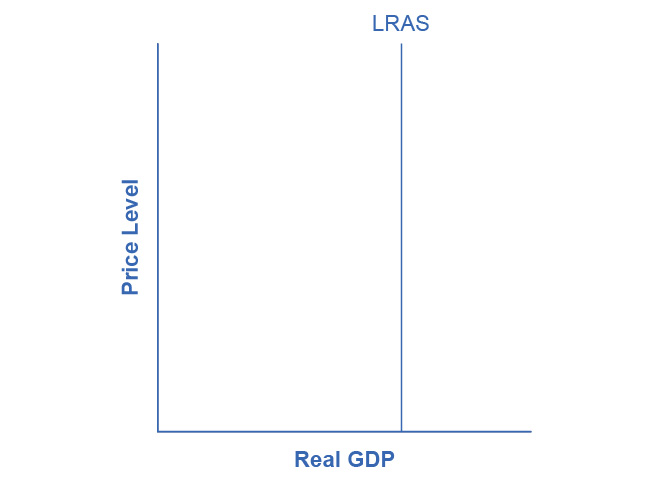

|

|---|

| Neoclassical economists subscribe to the vertical LRAS curve. It gradually shifts to the right due to advancements in production etc., which they describe as “long-term economic growth”. |

Wage and Price Flexibility

As opposed to the sticky wages and prices of Keynesian economics, change can occur in the long run.

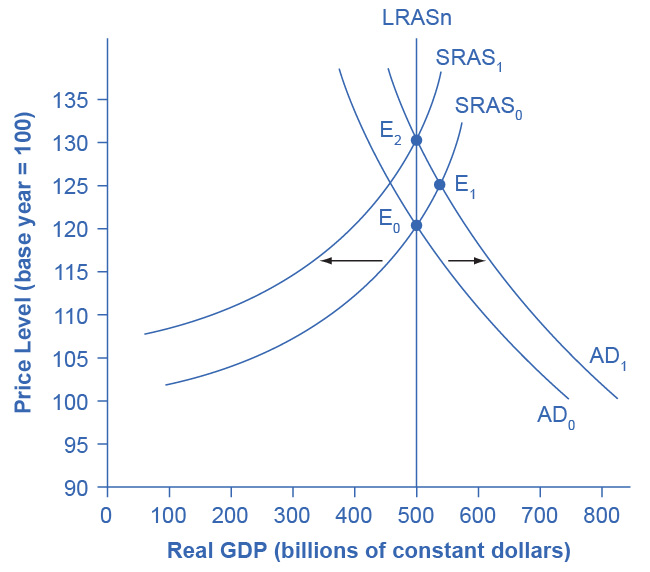

|

|---|

| Consider a scenario where AD shift to the right, resulting in an equilibrium above the LRAS curve. Unemployment is too low, so employers compete for workers, perhaps by increasing wages. The SRAS curve shifts left, resulting in a new equilibrium intersecting LRAS. |

Rate of Change of the Economy

Rational expectation theory suggests that accurate expectations are made with all available information. Prices change quickly to meet expectations instead of waiting for events to actually occur.

- If everyone had rational expectations, firms would respond to shifts in AD without making short-run changes, rather immediately moving to the expected long-run change.

Adaptive expectation theory suggests that expectations are made by referring to past experiences, gradually adjusting with changes in circumstance. These expectations are imperfect.

Neoclassical Policy

Neoclassical economists believe that Keynesian policies rely too much on the ability of the government to make effective decisions which come into effect too slowly.

The Phillips Curve

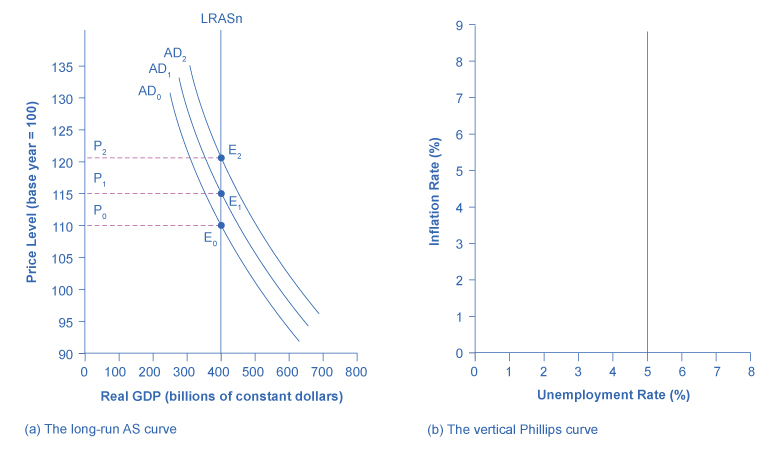

|

|---|

| In the neoclassical model, putput stays constant with shifts in AD at the cost of inflation, The unemployment rate is always the natural rate of unemployment regardless of inflation. |

While the government alters AD to meet potential GDP and control unemployment in the Keynesian model, the neoclassical model sees AS as the determinant of GDP.

Inflation and Unemployment

In the neoclassical model, cyclical unemployment is a non-issue. The focus of policy should be to reduce the natural rate of unemployment, which can be accomplished by cutting down on welfare and incentivizing job-hunting.

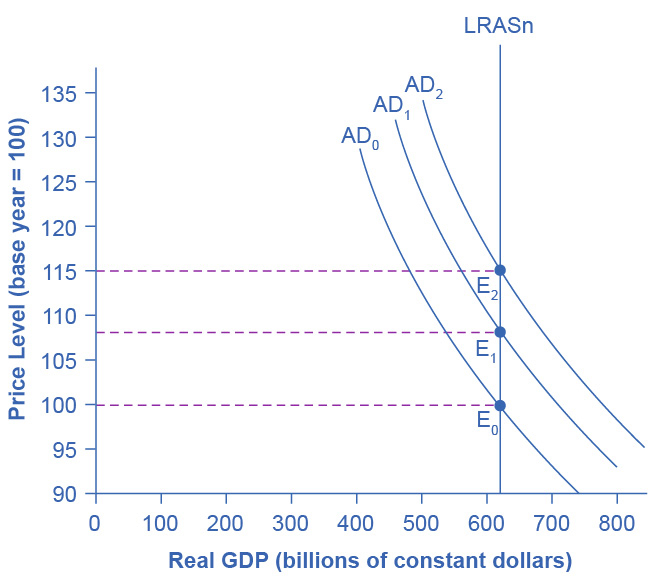

|

|---|

| Increasing AD only serves to drive inflation while GDP is stagnant and unemployment stays at its natural rate. Moving to decrease AD incurs no cost to GDP or unemployment either while decreasing the price level. |

To drive GDP growth in the long run, governments should promote investment in capital and encourage innovation. This is because the neoclassical model assumes that recessions will always be corrected, shifting the focus to growth.

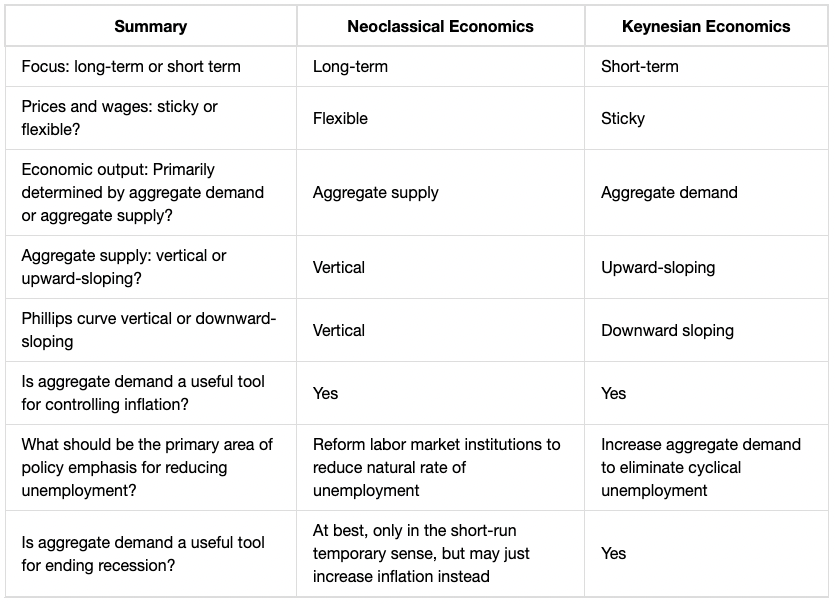

Comparison With the Keynesian Model

|

|---|

| Openstax table |

Modern economic models incorporate both views.