In a barter system, goods are directly traded for one another if the wants of two people coincide.

Monetary Functions

Money is:

- A medium of exchange, which serves an intermediate role

- A store of value, which does not need to be spent immediately

- A unit of account, the value of which can be measured

- A standard of deferred payment, which will be accepted in the future

Fiat Currency

Commodity money refers to goods that have intrinsic value which are used as money.

- Commodity-backed currencies are currencies backed up by commodities such as gold which are held at a bank

Fiat money lacks intrinsic value, gaining value from the trust in its backing government.

Measuring Money

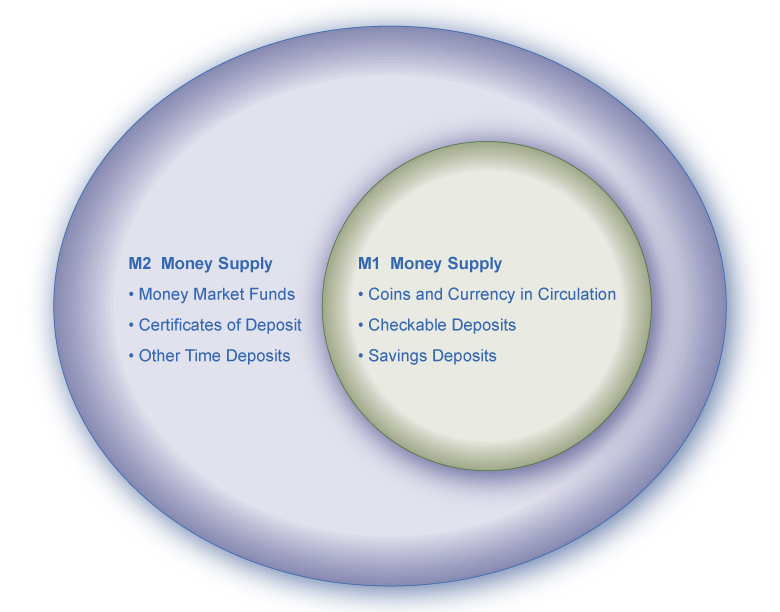

In the United States, the Federal Reserve Bank measures money by two definitions: The M1 money supply and the M2 money supply.

|

|---|

| The M1 supply consists of circulating currency and checking/savings accounts. The M2 supply includes money market funds, CODs, and other time deposits in addition to the M1 supply. |

Banks

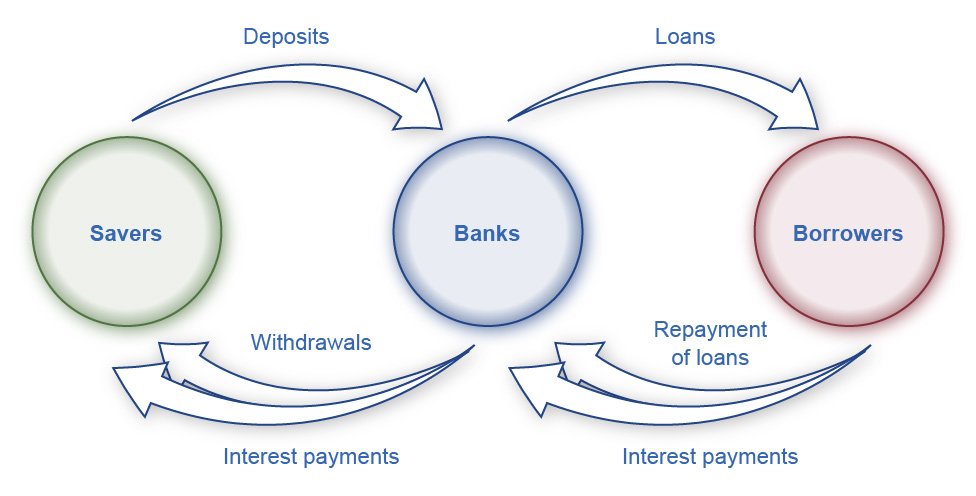

Payment systems facilitate the movement of money. When a borrower is looking for cash, banks can connect them with lenders for a transaction cost.

|

|---|

| Banks are financial intermediaries because they collect deposits from savers and give loans to borrowers. Insurance companies and pension funds are intermediaries but not depository institutions since they do not hand out loans from deposits. |

Balance Sheets

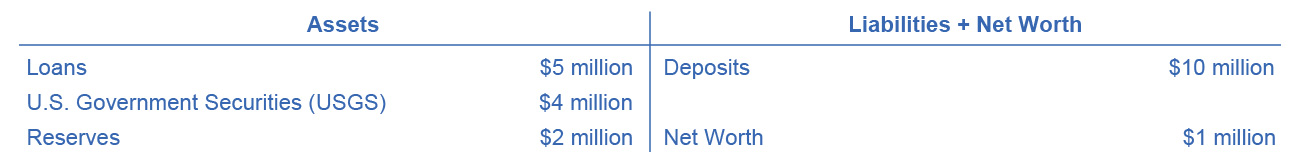

Balance sheets list assets and liabilities:

- Assets are owned and hold value

- Reserves refers to money that is kept on hand without being lent that does not generate interest

- Limited reserves means a bank keeps reserve only at the required amount

- Ample reserves means a bank is keeping reserves far above the require amount

- Liabilities are debts or something owed

- Net worth refers to assets minus liabilities

- A bank’s net worth is called bank capital

|

|---|

| A T-account displays assets and liabilities |

Bank Bankruptcy

Asset-liability time mismatch occurs when more money is withdrawn than the bank has on hand, as long-term assets cannot be paid out immediately.

Banks must offer competitive interest rates while ensuring more money flows in than out. Through diversification, banks offer a wide array of loans can balance out the risk of high defaults in one category of lending.

Financial institutions can also sell their loans on the secondary market where price is determined by risk. However, banks will inevitably decline in net worth during long recessions due to widespread defaults.

Creating Money

In fractional-reserve banking, banks need not keep all customer deposits in reserves. Only the reserve requirement must be met, and the rest may be lent. These loans, when deposited at other banks, enter the M1 supply.

The Money Multiplier Formula

To calculate the change in money supply in a fractional-reserve system based on reserves above the requirement, the money multiplier formula can is used.

Using the above formula, we can calculate the money generated by $100,000 given a reserve requirement of 20%.

The money multiplier assumes that banks lend out all but the required reserves, however excess reserves may be kept, such as during recession.

Money saved in the form of physical cash cannot enter the banking system, so it does not get multiplied. These savings reduce an economy’s quantity of money and loans and occurs frequently in low-income countries where banks are not trusted.