Aggregate Demand

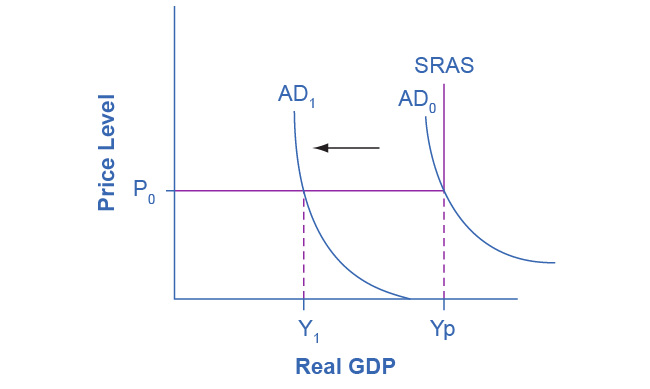

According to Keyne’s Law, potential GDP should be determined by the availability of inputs and real GDP by the amount of goods sold, dependant on how much demand exists.

|

|---|

| In the Keynesian model, SRAS remains flat until potential GDP. Price does not change with AD shifts, only real GDP (output). |

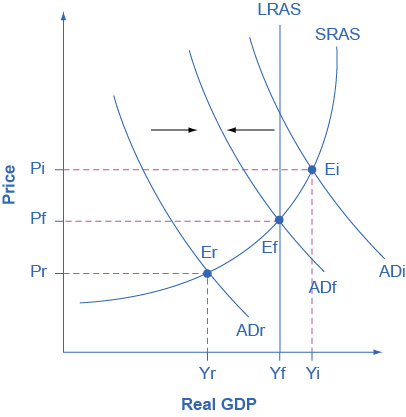

A recessionary gap is when equilibrium falls below potential. Unemployment is high and the government can step in by increasing spending.

An inflationary gap is when equilibrium falls above potential. Inflation is high and the government can step in by decreasing spending.

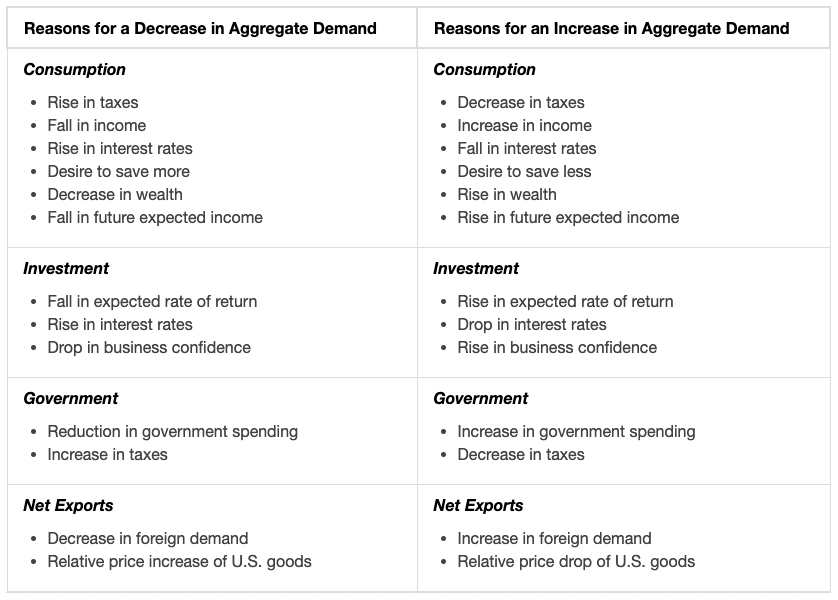

Components of Aggregate Demand

Consumption:

- Disposable income: Income after taxes

- Expected future income: How optimistic consumers are about future income

- Wealth: How wealthy households are, including access to credit

Households consume durable and nondurable goods, as well as services.

- Durable goods are long lasting, such as vehicles

- Nondurable goods are immediately consumed, such as groceries

Investment:

- Expected future profit: How much businesses project to make

- Investment costs: Interest rates

The four categories of investment are:

- Durable equipment, software, etc.

- (Changes in) Inventory

- Nonresidential structures

- Residential Structures

The profitability of investments can be affected by factors such as input costs (energy) and government policy.

Government Spending:

- Governments provide services including:

- National defence

- Transport infrastructure

- Education

- Changing tax rates to alter consumption and spending

- Providing handouts to stimulate spending and protect jobs

Net exports:

- Changes in relative growth rates

- Changes in relative domestic and foreign prices

|

|---|

| Openstax summary |

Keynesian Recession

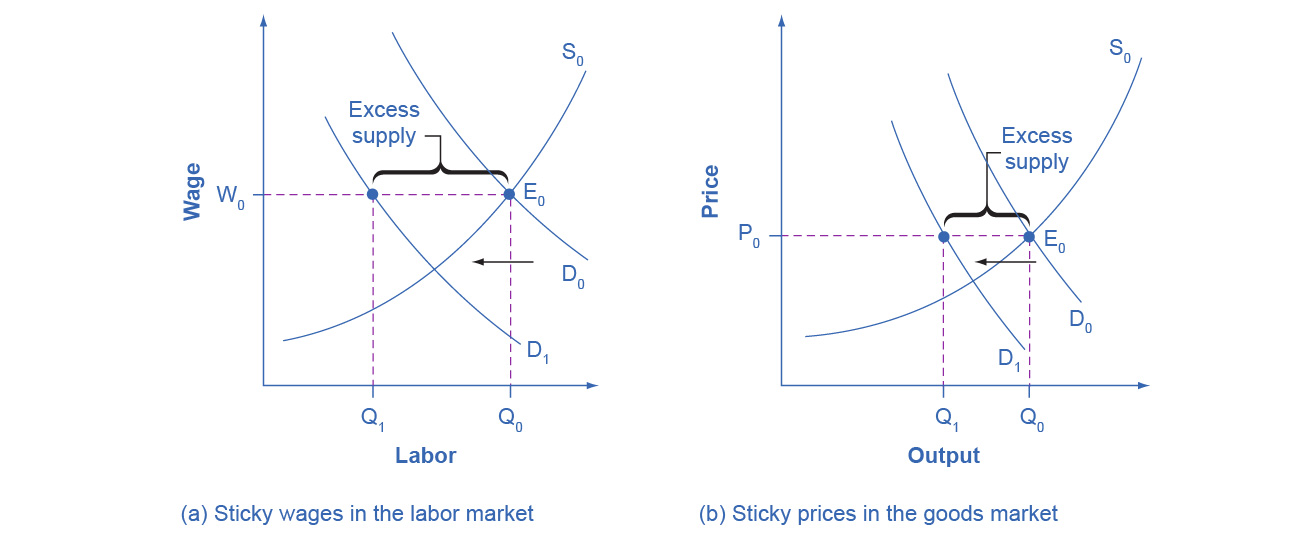

When more goods are produced than are demanded, the economy falls into recession. This is because potential GDP is not reached and more people are unemployed, such as during the Great Depression.

Consider a scenario in which the housing or stock market crashes. Households become less wealthy, reducing their spending. Firms see this as a signal to decrease production and investment.

The coordination argument reflects the difficulty of organizing reductions in pay and many steps are taken to keep wages from falling.

Prices are sometimes also considered sticky. Fluid prices are confusing for consumers and require resources. These costs are called menu costs.

|

|---|

| Sticky wages and prices cause disequilibrium, resulting in unemployment and recession. |

The Keynesian model operates under the assumption that wages and prices are both sticky. Otherwise, price levels would fall to lift GDP.

The Expenditure Multiplier

The expenditure multiplier is the idea that spending is very powerful, causing a change in GDP that is more than proportional.

The Phillips Curve

|

|---|

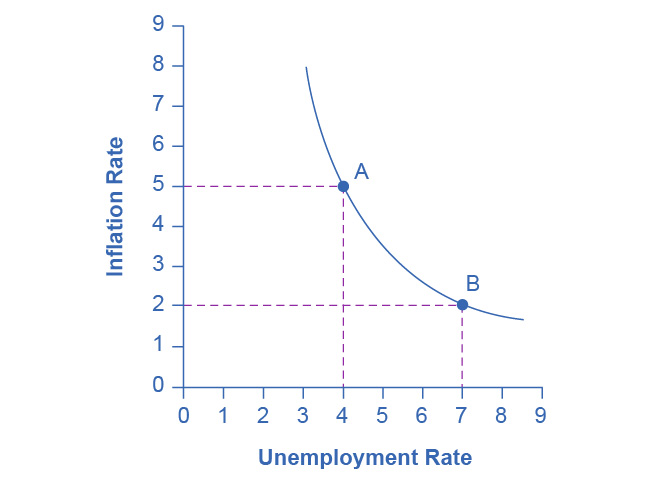

| The Phillips curve demonstrates the theoretical tradeoff between inflation and unemployment |

The Phillips curve generally holds true in the short run. Supply shocks and changes to inflationary expectation can cause it to shift.

Keynesian Policy

|

|---|

| Expansionary fiscal policy includes tax cuts and increased government spending to shift AD to the right. Contractionary fiscal policy includes tax increases and decreased government spending to shift AD to the left. |